Divestment 2.0: launch of "Global Coal Exit List" for the finance industry

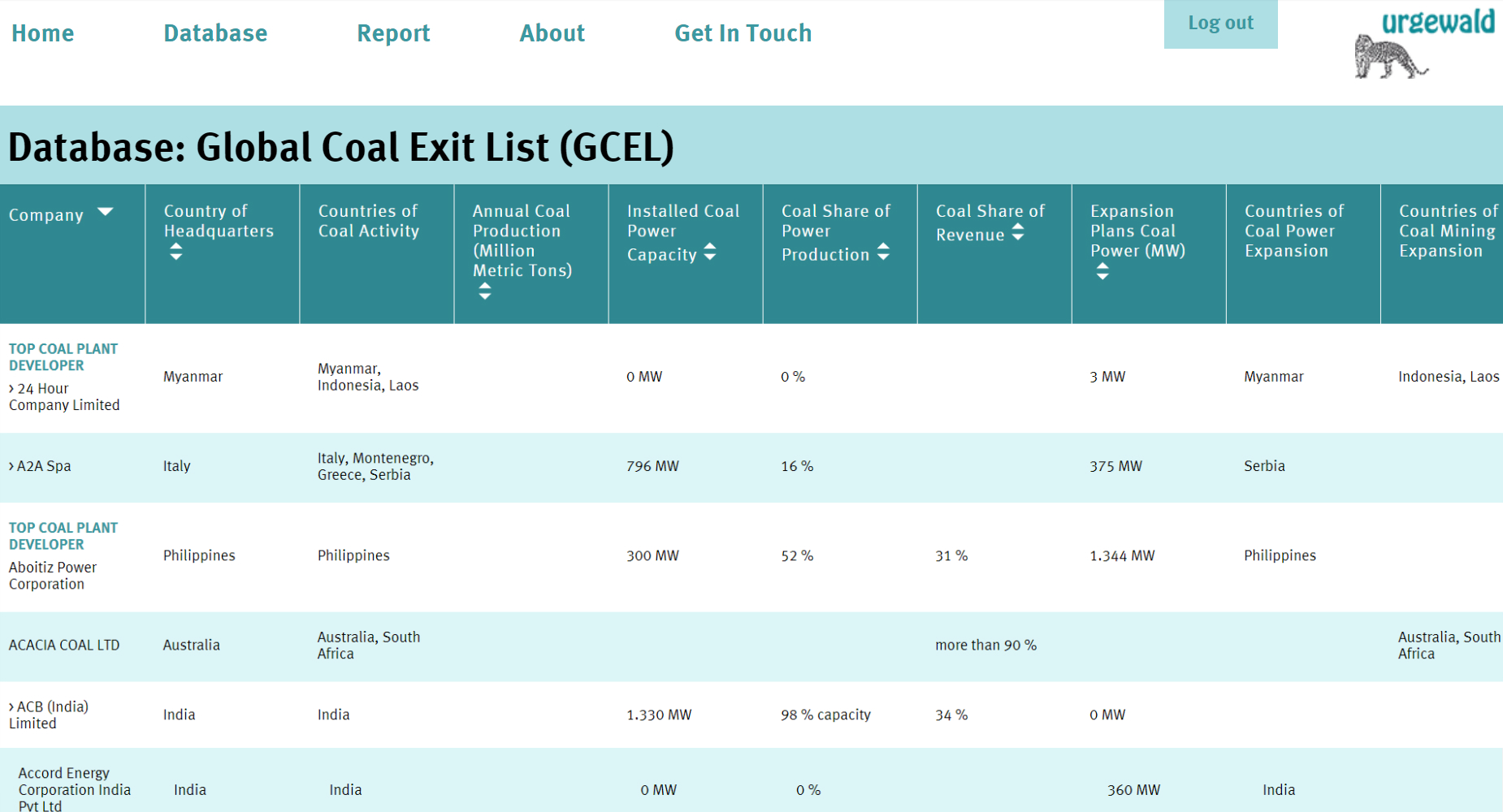

At the UN Climate Summit in Bonn, the German environment NGO Urgewald and its partners published the “Global Coal Exit List” (GCEL), a comprehensive database of companies participating in the thermal coal value chain. While most coal databases used by the finance industry only cover around 100 companies, the GCEL provides key statistics on over 770 companies whose activities range from coal exploration and mining, coal trading and transport, to coal power generation and manufacturing of coal plants. The database and charts on the coal industry can be viewed at: www.coalexit.org.

“We developed the GCEL to provide the finance industry with a concise list of companies that should be divested,” says Heffa Schuecking, director of Urgewald. “Our research shows that the universe of companies with significant coal-related business is much larger than investors think. Keeping to a 1.5°C pathway will be impossible unless banks and investors make a speedy and full exit from investments in the coal industry.”

AXA: “Great tool for investors who want to move portfolios away from coal.”

But to do so, they must know who the industry is. “It is not always easy to identify coal companies. They can hide behind names like ‘Lemur Resources’, ‘Silver Unicorn Trading’ or ‘Africa China Sunlight Energy’,” explains Schuecking. “Effective divestment from the coal industry requires solid company-based data and this is what the Global Coal Exit List provides.”

The GCEL provides key statistics on companies’ annual coal production and coal share of revenue, their installed coal-fired capacity and coal share of power production. These statistics were drawn from original company sources such as annual reports, investor presentations and company websites. All in all, the companies listed in the GCEL represent over 90% of world coal production and 86% of the world’s coal-fired capacity.

As Sylvain Vanston from the Corporate Responsibility Division of the insurance company AXA says: “The GCEL is amongst the most thorough coal databases we have seen. It is a great tool for investors who want to move their portfolios away from coal.”

The First Forward-Looking Divestment Tool

A unique feature of the GCEL is the fact that it also provides information on companies’ plans to expand coal mining or develop new coal-fired power stations. It is thus the first “forward-looking” coal divestment tool. The GCEL identifies 225 companies that are planning new coal mines or coal mine extensions and 282 companies that are planning new coal-fired power stations.

“We’ve discovered that a significant portion of these companies are not traditional coal industry players,” says Schuecking. A typical example is Marubeni – a huge diversified Japanese trading house, but also the world’s 26th largest coal plant developer with plans to build over 5,800 MW of new coal plants in 9 countries.

“The GCEL is a practical tool that enables financial institutions to identify the ‘coal content’ of their portfolios, to avoid new coal investments and to accelerate their departure from the industry. We hope it will be widely used,” says Schuecking. “A speedy exit from coal investments by the finance industry is not just a question of avoiding stranded assets, but of maintaining a livable world.”